FAB Balance Check Online & Enquiry

Checking your FAB and NBAD balance just got easier! No more frantic searching or confusing steps.

Checking your FAB bank balance can be done through various methods depending on your preference and availability of resources. The primary methods include using the online portal, the FAB mobile app, or an ATM. You can check the balance of NBAD and FAB with the same process.

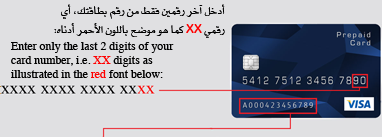

آخر رقمين من رقم البطاقة:

Last 2 digits of Card No:

رقم تعريف البطاقة:

Card ID:

Online Portal FAB Balance Check:

Check your fab bank account balance online with their official website in a few clicks.

Total Time: 2 minutes

Keep your Fab Card Read

To check the fab balance online through their official website you have to keep your card ready to enter the details.

Visit Official Website

Visit their official website: https://ppc.magnati.com/ppc-inquiry/

Enter the Last 2 Digits of the Card

At the top box enter the last two digits of your debit or credit card.

Enter the 16 Digits

In the below box enter your 16 digits Card ID which is at the end of your card.

Press Go

Press the Go Button to log in on the First Abu Dhabi, bank account and to view your remaining current balance.

2. FAB Mobile App Balance Check:

- Download the FAB bank App from the Play Store or App Store.

- If you are already a customer, click on “Already a customer”.

- Enter your Customer ID or Credit Card Number, and check the terms & conditions box.

- Click on “Continue” to log in to your account and complete the FAB bank balance check process.

3. ATM Balance Check:

- Locate a FAB ATM or an affiliated one.

- Insert your card into the slot and enter your PIN when prompted.

- Once you have correctly entered it, the ATM will show you options, among which should be the option to inquire about the balance. Select it to check your balance on the screen.

Quick Takeaway Of NBAD Balance Check

Online Portal:

- Website: ppc.bankfab.com

- Card info needed: Last 2 digits of card number, Card ID (bottom left corner)

- Speed: Fastest method

FAB Mobile App:

- Download: App Store or Play Store

- Log in: Access balance, transfers, payments

- Convenience: Check balance on the go

ATM Network:

- Location: Any FAB or affiliated ATM

- Steps: Insert card, enter PIN, choose “Balance Inquiry”

- Fees: May apply for withdrawals

Phone Banking: ☎️

- Number: +971 600 541000

- Assistance: Balance inquiry and other banking needs

- Personal touch: Speak to a representative

NBAD Balance Check

- Online Portal: This is the fastest way! Head to ppc.bankfab.com and enter the last two digits of your card number and the Card ID (that little number on the bottom left corner). Click “Go” and bam! Your balance and recent transactions are all yours.

- FAB Mobile App: Download the FAB app and log in. Boom! Your NBAD balance is front and center, ready to be admired (or used responsibly, of course). You can also transfer money and pay bills, all from your phone. Fancy, huh?

- ATM Network: Find any FAB or affiliated ATM, stick in your card, and enter your PIN. Choose “Balance Inquiry” and watch your current balance appear. Just remember, ATMs might charge fees for withdrawals, so be mindful.

- Phone Banking: Dial +971 600 541000 and follow the prompts. A friendly NBAD representative will be happy to tell you your balance and answer any other banking questions you might have. Bonus points for avoiding endless menus!

Bonus Tip: Forget your Card ID or PIN? No worries! Enroll in FAB’s SMS Alert service. Every transaction gets sent straight to your phone, keeping you informed and in control.

Benefits of FAB Prepaid Card:

FAB prepaid card offers various benefits to both employees and employers:

- For Employees: No minimum balance required, no bank account required, free accident insurance, worldwide usability, 24/7 customer care, WPS safety, SMS alerts, and a user-friendly online portal.

- For Employers: Automatic payroll management, online card services, paying salaries using net-banking, and secure transfers.

FAB Cashback Offers:

FAB Bank provides cashback offers for salaried individuals. The cashback is earned on every salary transfer and varies depending on the monthly salary range and whether you are a UAE citizen or a foreigner. You can use the cashback to shop, pay bills, or withdraw cash. For example:

- UAE Citizens: Up to AED 5000 cashback.

- Foreigners: Eligible for a cashback of AED 2500.

This guide provides a comprehensive understanding of the FAB bank balance check process and associated benefits, aiming to enhance user convenience and financial management with FAB Bank.

What is the minimum balance in FAB Bank?

There is no minimum bank balance required. However, the chequebook and the internet banking you will get as a complimentary service.

Is NBAD and FAB Same?

First Abu Dhabi Bank (FAB) (Arabic: بنك أبوظبي الأول) is the largest bank in the United Arab Emirates. It was formed following a merger between First Gulf Bank (FGB) and the National Bank of Abu Dhabi (NBAD).